Leverage Definition: What Is Leverage?

Content

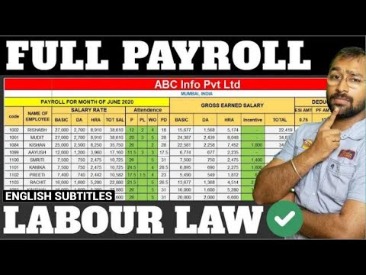

Buying on margin is the use of borrowed money to purchase securities. Buying on margin generally takes place in a margin account, which is one of the main types of investment account. When you borrow money to pay for school, you’re using debt to invest in your education and your future. Higher salary lets you recoup your initial debt-financed investment.

Its mission is to ensure an orderly resolution of failing banks with minimum impact on the real economy, the financial system, and the public finances of the participating member states and beyond. The use of a small initial investment to gain a relatively high return. You will of course, make your own judgment after weighing up all the pros and cons of financial leverage. Here, traders increase their market exposure at the lower short-term rate and invest it at the significantly higher long-term rate, potentially enabling them to profit from the difference between the two.

OTHER WORDS FROM leverage

A good deal of confusion arises in discussions among people who use different definitions of leverage. The term is used differently in investments and corporate finance, and has multiple definitions in each field.

Harold Averkamp has worked as a university accounting instructor, accountant, and consultant for more than 25 years. To use; to exploit; to manipulate in order to take full advantage .They plan to leverage the publicity into a good distribution agreement. The ability to earn very high returns when operating at high-capacity utilization of a facility. In such cases where there is a multiple capital structure the factor known as leverage comes into play. The former Forest man, who passed a late fitness test, appeared to use Guy Moussi for leverage before nodding in David Fox’s free-kick at the far post – his 22nd goal of the season. DisclaimerAll content on this website, including dictionary, thesaurus, literature, geography, and other reference data is for informational purposes only.

Evaluating Financial and Operational Leverage

A higher degree of operating leverage demonstrates a higher level of volatility within the company. Investors can also apply this investment strategy by using different tools, such as options, futuresand margin accounts. However, if an investor is risk-averse or doesn’t feel confident using leverage, there are options available to leverage their investments indirectly.

A company can also compare its debt to how much income it makes in a given period. The company will want to know that debt in relation to operating income that is controllable; therefore, it is common to use EBITDA instead of net income. A company that has a high debt-to-EBITDA is carrying a high degree of weight compared to what the company makes. (Valium)

Share

https://personal-accounting.org/ with high ongoing expenses, such as manufacturing firms, have high operating leverage. High operating leverages indicate that if a company were to run into trouble, it would find it more difficult to turn a profit because the company’s fixed costs are relatively high. Every investor and company will have a personal preference on what makes a good financial leverage ratio. Some investors are risk adverse and want to minimize their level of debt. Other investors see leverage as opportunity and access to capital that can amplify their profits. Leverage can offer investors a powerful tool to increase their returns, although using leverage in investing comes with some big risks, too. Leverage in investing is called buying on margin, and it’s an investing technique that should be used with caution, particularly for inexperienced investors, due its great potential for losses.

- Investors can calculate operational leverage by dividing the company’s change in earnings per share by its percentage change in its earnings prior to interest and taxes.

- Team Tony cultivates, curates and shares Tony Robbins’ stories and core principles, to help others achieve an extraordinary life.

- Fourth, collaborations should assign clear roles and responsibilities that value and leverage the strengths of all team members and institutions.

- Adam received his master’s in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology.

- The formulas above are used by companies who are using leverage for their operations.

- Winning investment are amplified, potentially creating drastic profit.

Team Tony cultivates, curates and shares Tony Robbins’ stories and core principles, to help others achieve an extraordinary life. Career counselors know well the networking opportunities your past education and current, possibly vibrant, local alumni chapter offers. Often, a career counselor’s first advice for job seekers revolves around reconnecting with college alumni associations and connections. They know recruiters and business owners look for anything to connect with a job candidate. Exploring the common experience helps them evaluate whether they’re a fit for the company or not. Connections are critical because they jump you ahead on the learning curve in many areas.

A deep, liquid and relatively calm market will require a smaller margin, perhaps 5 or 7% of the value of the position, while a volatile market will see traders asked for more margin, perhaps 10% or more. Margin rates can also vary according to the regulatory rules in the country in which your account is based. However, if evaluating these company records is not your expertise, you may want to explore other investment options.

- Leverage can be used in short-term, low risk situations where high degrees of capital are needed.

- The company will want to know that debt in relation to operating income that is controllable; therefore, it is common to use EBITDA instead of net income.

- But they do charge interest and have relatively short repayment terms, meaning your investment would have to earn at least enough to cancel out the interest you’d accrue quickly.

- If the value of your shares fall, your broker may make a margin call and require you to deposit more money or securities into your account to meet its minimum equity requirement.

- Leverage is when you use borrowed funds to increase the potential return of an investment.

Leverage can also refer to the amount of debt a firm uses to finance assets. Optimizing client interactions builds momentum that businesses can leverage as a kind of organic marketing. Identify opportunities to advance your company’s purpose and strategy and leverage your unique capabilities. The bank was asked to improve its capitalization and reduce its leverage. States do not have the economic leverage to influence a foreign country.

Now that the value of the Leverage Definition decreased, Bob will see a much higher percentage loss on his investment (-245%), and a higher absolute dollar amount loss because of the cost of financing. Operating leverage can also be used to magnify cash flows and returns, and can be attained through increasing revenues or profit margins. Both methods are accompanied by risk, such as insolvency, but can be very beneficial to a business. In accounting and finance, leverage is the use of a significant amount of debt to purchase an asset, operate a company, acquire another company, etc. The Basel standards require banks to maintain a Tier 1 leverage ratio of at least 3%. Global systemically important banks should maintain an extra leverage ratio buffer, which the Basel Committee agreed in December 2017 to set at 50% of a bank’s risk-weighted capital buffer. The size of this small cash stake, known as a margin payment, varies with the types of assets and markets in which you want to trade.

You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy. Misuse of leverage may have serious consequences, as there are some that believe it played a factor in the 2008 Global Financial Crisis. In 2023, however, multiple forces in society will finally converge to expand funding for female-focused research and leverage scientific breakthroughs to extend reproductive longevity.